Start Strong: Your Daily Bookkeeping Must-Dos

Spend just 15–20 minutes each day on these essential tasks:

- Record all transactions: Sales, expenses, refunds, vendor payments.

- Check your bank feeds: Ensure your software matches your account.

- Keep receipts organized: Use apps to snap and store.

- Monitor cash flow: Are you bringing in more than you’re spending?

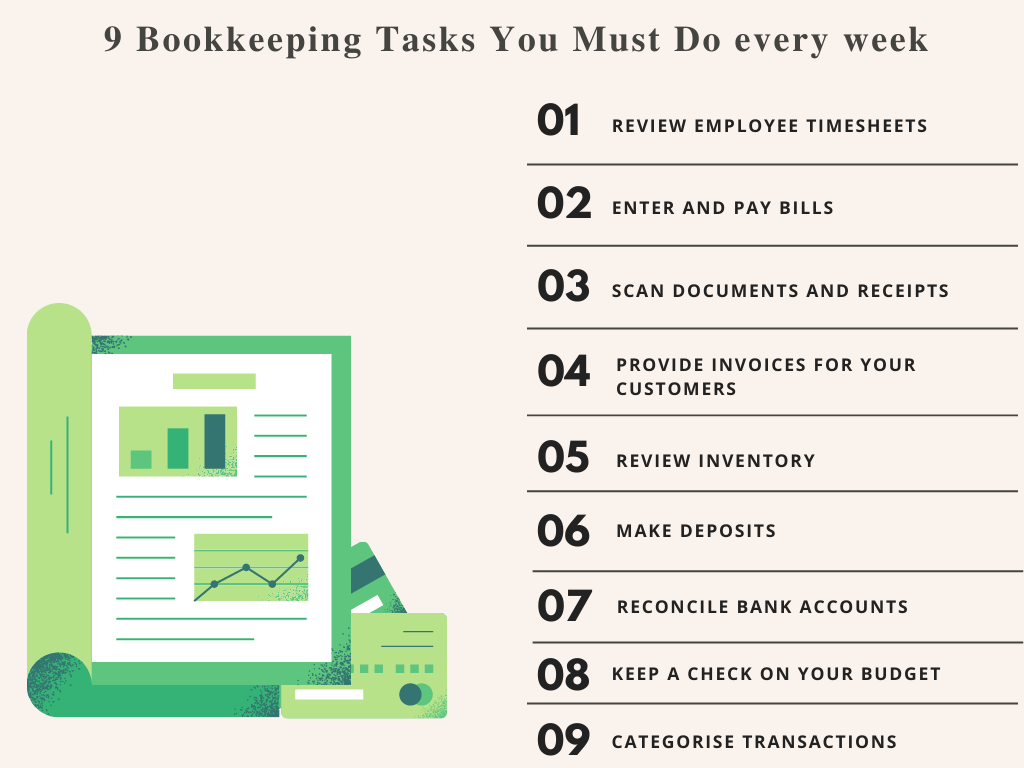

Weekly Habits That Keep Your Books in Check

Set aside time once a week for these crucial reviews:

- Reconcile accounts: Match statements with your ledger.

- Review unpaid invoices: Follow up on late payments.

- Track expenses by category: Simplify tax prep.

- Back up your data: Keep both cloud and offline copies.

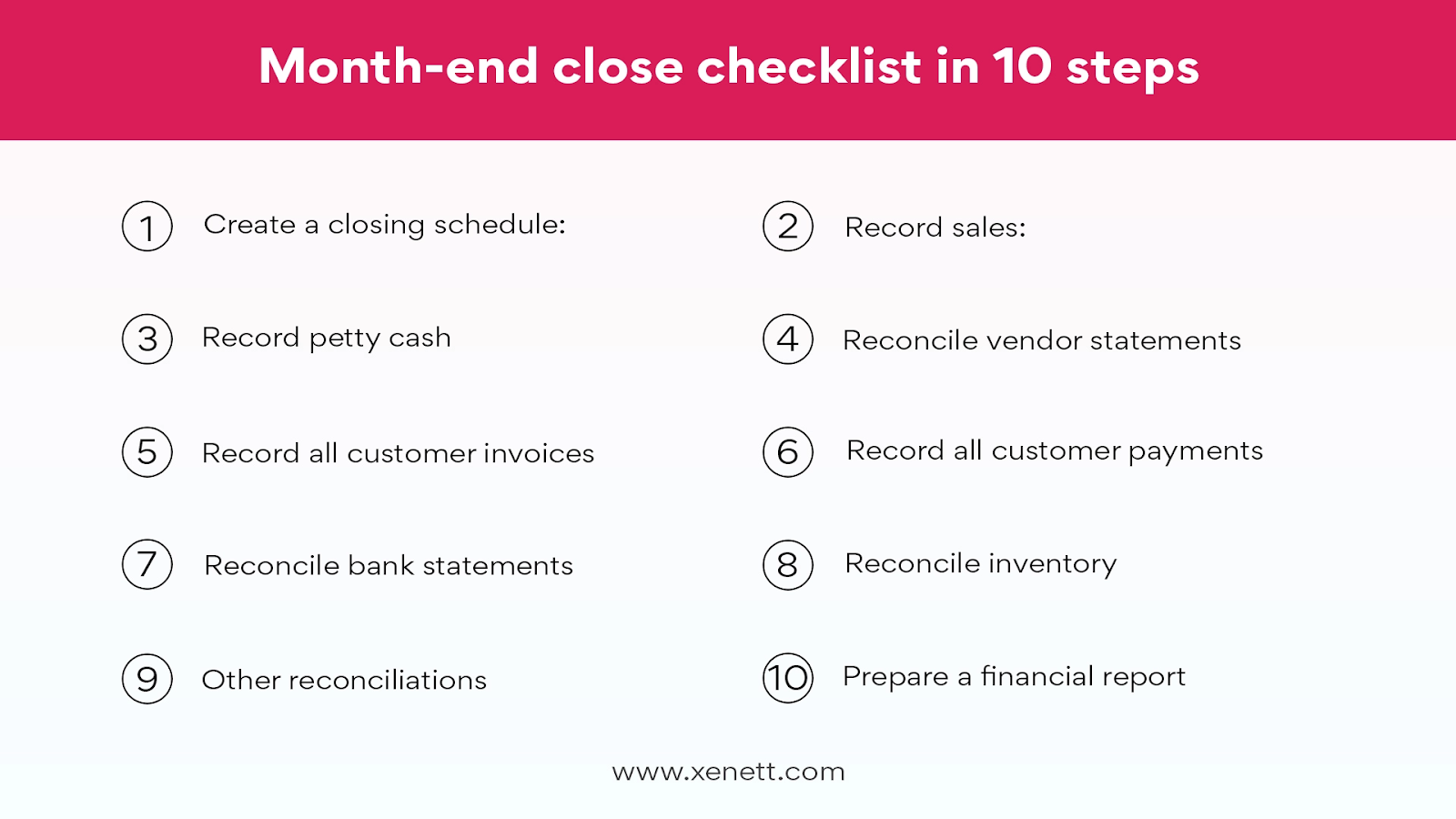

Monthly Tasks to Catch Errors Before They Grow

At month-end, run through these checks:

- Generate reports: Profit & loss, balance sheet, cash flow.

- Audit payroll: Verify employee payments and tax withholdings.

- Review vendor accounts: Check for discounts and overpayments.

- Update your budget based on actual results.

Credit of image to Xenett.com

Quarterly Reviews to Stay Tax-Ready All Year

Every quarter, include these in your checklist:

- Review estimated taxes and adjust payments.

- Analyze performance metrics: sales trends, margins.

- Revisit financial goals and strategies.

- Meet with your accountant or bookkeeper.

Year-End Wrap-Up: Closing the Books with Confidence

Finish the year strong with these final steps:

- Review and reconcile all accounts one last time.

- Ensure all transactions are recorded: No expense left behind.

- Collect W-9s and send 1099s for contractors over $600.

- Double-check inventory, if applicable.

- Meet with your tax professional to prepare for filing.

Takeaway

Bookkeeping is the foundation of your business year-round. Start small, be consistent, and turn these tasks into habits. When your books are in order, your decisions and growth follow.

Why Choose Tax IRS Services

At Tax IRS Services, we’re more than bookkeepers—we’re your financial partners. We’ll help you build and maintain your checklist so you can focus on running your business with confidence.

FAQs

You risk missing errors, losing receipts, and scrambling at month-end.

Software helps, but human review is still key. Automation + oversight = best results.

Ideally daily. At minimum, follow the Daily and Weekly schedule.

Use cloud-based software with auto-backup and a secondary offline copy.

It’s your final record for the year; taxes, reports, and planning depend on its accuracy.